Mission

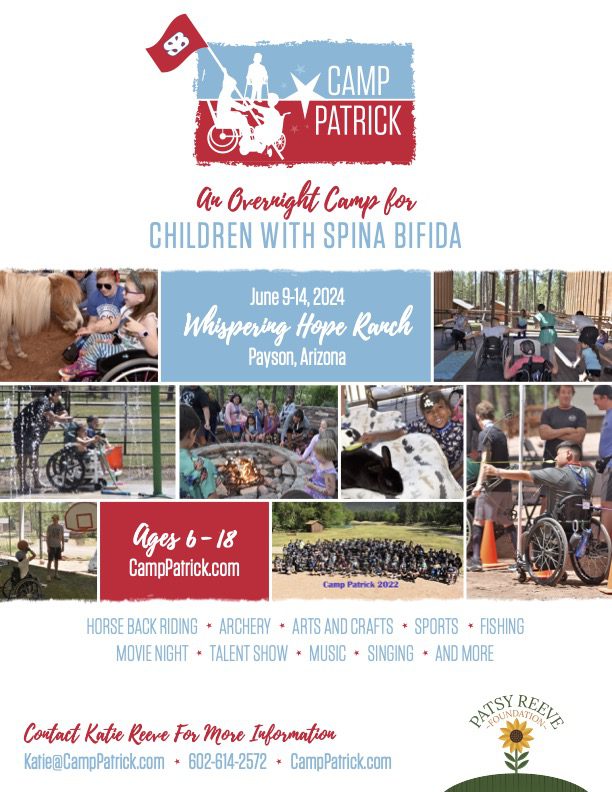

Camp Patrick is a unique camp experience for children with spina bifida, aged 6-18, where they can strengthen their independence, try new things, and build lifelong friendships. The camp provides a supportive environment for both campers and their families.

Basic Information

Tax-Exempt

Founded in

2017

EIN

82-1059864

Total Assets

$289.7 thousand

At a Glance

6th Annual Touch a Truck

A fundraiser allowing children and families to explore various vehicles while supporting Camp Patrick.

Under the Stars Gala - Kentucky Derby

An exciting event themed around the Kentucky Derby, promoting community engagement for Camp Patrick.

Camper Registration

Information for signing up campers for Camp Patrick, focusing on those with spina bifida.

Upcoming Events

6th Annual Touch a Truck

February 1, 2025

A fundraising event featuring various vehicles for children to explore.

Learn More

Under the Stars Gala - Kentucky Derby

March 22, 2025

A gala event with a Kentucky Derby theme.

Learn MoreVolunteer Opportunities

Volunteer at Camp Patrick

Get involved by helping out during the camp week. Various roles available.

MIP Score (Beta)

The MIP Score is in beta! We'd love any feedback you may have.

The MIP Score and it's methodology is purely used as a way to visualize how a nonprofits public financial data compares against others. It doesn't reflect the unique circumstances and impact that a nonprofit has.The MIP Score should never be used to say one charity is better than another.

Overall Score

55

40

/100

Program Expense Ratio

93.74%

20

/20

Program Revenue Growth

0.00%

2

/20

Leverage Ratio

0

2

/20

Working Capital Ratio

1.459

12

/20

Fundraising Efficiency

46.51

4

/20

Latest Filing Data: Form 990

Fiscal Year:2021

Source:Source: Self-reported by organization

Financial Details

Revenue

| Category | Amount | Percentage |

|---|---|---|

| Contributions, Gifts, and Grants | 275.2K | 99.82% |

| Program Services | 0 | 0.00% |

| Investment Income | 125 | 0.05% |

| Sales of Non-Inventory Assets | 0 | 0.00% |

| Other Notable Sources | 0 | 0.00% |

| Total Revenue | 275.7K | 100.00% |

Related Nonprofits

Patsy Reeve Foundation Inc.

Human Services

Human Services AssociationWichita County Medical Alliance

Human Services

Human Services AssociationNational Association of Black

Human Services

Human Services AssociationSocial Innovation Forum Inc.

Human Services

Human Services AssociationNational Association of Community and Restorative Justice

Human Services

Human Services Association