Mission

The Committee for a Responsible Federal Budget serves as an independent source of objective policy analysis on fiscal and economic matters. They regularly engage with policymakers, helping them develop and analyze proposals to improve the country’s fiscal condition while also acting as a watchdog to educate the public and assist journalists in understanding important fiscal developments.

Basic Information

Tax-Exempt

Founded in

1981

EIN

52-1231278

Total Assets

$5.725 million

At a Glance

US Budget Watch 2024

A project designed to educate the public on the fiscal impact of presidential candidates’ proposals.

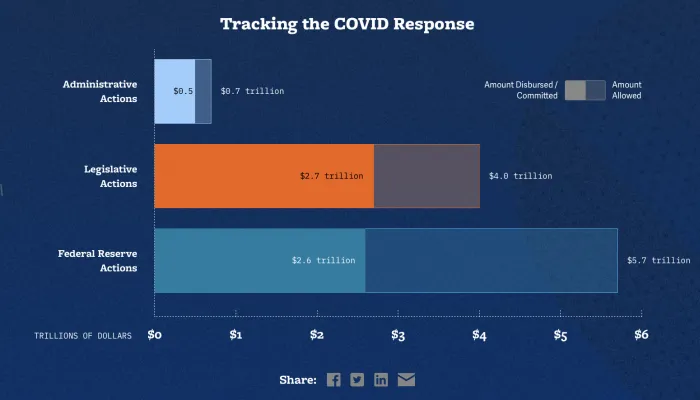

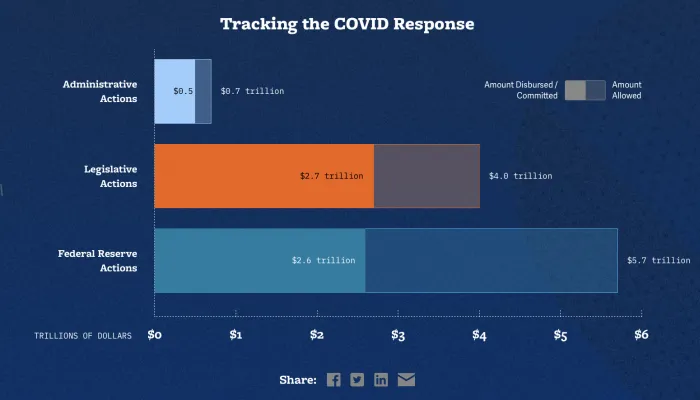

COVID Money Tracker

Track trillions of dollars in federal spending linked to the coronavirus pandemic.

Fix the Debt

Mobilizing Americans to urge policymakers to evaluate the rising national debt.

Past Events

Watch: The Fiscal Impact of the Harris and Trump Campaign Plans

2024-10-16

A discussion on the fiscal impact of the campaign plans of various presidential candidates.

2024 Budget Bash Reception

2024-09-18

An annual reception held to address important budgetary issues.

Watch: Checking in on the Medicare & Social Security Trust Funds – May 2024

2024-05-07

A briefing on the current state of Medicare and Social Security Trust Funds, highlighting concerns over insolvency.

2024 Fiscal Heroes Reception

2024-05-01

A reception honoring fiscal heroes that have made significant impacts in fiscal policy.

When the TCJA Expires: A Tax Policy Summit

2024-03-28

A summit examining the expiring provisions of the TCJA and what future tax policies should look like.

Our Programs

US Budget Watch 2024

A project designed to educate the public on the fiscal impact of presidential candidates' proposals.

Learn More

COVID Money Tracker

Tracks the financial decisions surrounding COVID-19 relief measures and spending.

Learn More

Health Savers Initiative

Works to identify policy proposals to make health care more affordable.

Learn MoreImpact Reports

MIP Score (Beta)

The MIP Score is in beta! We'd love any feedback you may have.

The MIP Score and it's methodology is purely used as a way to visualize how a nonprofits public financial data compares against others. It doesn't reflect the unique circumstances and impact that a nonprofit has.The MIP Score should never be used to say one charity is better than another.

Overall Score

58

50

/100

Program Expense Ratio

82.93%

14

/20

Program Revenue Growth

-9.03%

2

/20

Leverage Ratio

0.09051

20

/20

Working Capital Ratio

1.162

12

/20

Fundraising Efficiency

0

2

/20

Latest Filing Data: Form 990

Fiscal Year:2022

Source:Source: Self-reported by organization

Financial Details

Revenue

| Category | Amount | Percentage |

|---|---|---|

| Contributions, Gifts, and Grants | 6.959M | 98.88% |

| Program Services | 71.45K | 1.02% |

| Investment Income | 5K | 0.07% |

| Sales of Non-Inventory Assets | 0 | 0.00% |

| Other Notable Sources | 2.045K | 0.03% |

| Total Revenue | 7.038M | 100.00% |

Related Nonprofits

Committee for A Responsible Federal Budget

Societal Benefit

Financial AdministrationMeadowlands Transportation Brokerage Corp

Societal Benefit

Financial AdministrationNew Hampshire Fiscal Policy Institute

Societal Benefit

Financial AdministrationSimplifyct Inc.

Societal Benefit

Financial AdministrationCommunity Tax Aid Inc.

Societal Benefit

Financial Administration