Mission

The Mandell Winlow Security Foundation (MWSF) was established to address the increasing crime rates affecting the communities of Mandell Place, Winlow Place, and Cherryhurst. By forming the Constable Patrol Program, MWSF aims to create collaborations for better security and safety through increased neighborhood vigilance, education, and proactive crime prevention methods.

Basic Information

Tax-Exempt

Founded in

2015

EIN

47-3982268

Total Assets

$129.1 thousand

UN Sustainable Development Goals Supported

This organization contributes to the following United Nations Sustainable Development Goals. See the SDG page for more information.

Showing 1 of 1 goals

At a Glance

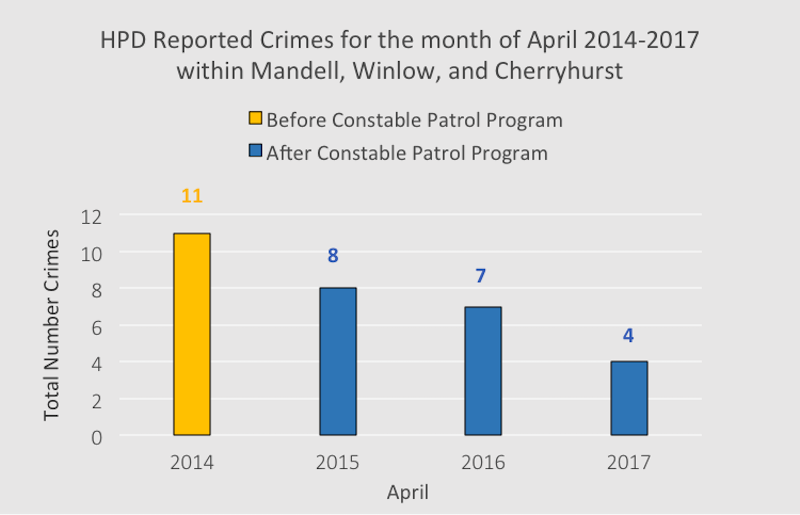

Constable Patrol Program Success

The Constable Patrol Program has successfully reduced various crimes, providing a safer environment for our neighborhoods.

Community Events

Visible signs and community events encourage safety awareness and participation in the patrol program.

Monthly Crime Statistics

Monthly crime statistics are compiled to track improvements in neighborhood safety.

Impact Stats

Varies (specific statistics unavailable but noted as significant)

Percentage Decrease

Crime Reduction

A significant decrease in crime incidents in the neighborhoods participating in the Constable Patrol Program.

Our Programs

Constable Patrol Program

A community program to enhance safety and security through regular patrols by local deputy constables.

Learn MoreMIP Score (Beta)

The MIP Score is in beta! We'd love any feedback you may have.

The MIP Score and it's methodology is purely used as a way to visualize how a nonprofits public financial data compares against others. It doesn't reflect the unique circumstances and impact that a nonprofit has.The MIP Score should never be used to say one charity is better than another.

Overall Score

44

34

/100

Program Expense Ratio

100.00%

20

/20

Program Revenue Growth

0.00%

2

/20

Leverage Ratio

0

2

/20

Working Capital Ratio

0.6561

8

/20

Fundraising Efficiency

0

2

/20

Latest Filing Data: Form 990

Fiscal Year:2022

Source:Source: Self-reported by organization

Financial Details

Revenue

| Category | Amount | Percentage |

|---|---|---|

| Contributions, Gifts, and Grants | 203.5K | 100.00% |

| Program Services | 0 | 0.00% |

| Investment Income | 0 | 0.00% |

| Sales of Non-Inventory Assets | 0 | 0.00% |

| Other Notable Sources | 0 | 0.00% |

| Total Revenue | 203.5K | 100.00% |

Related Nonprofits

Downtown Kingsport Association Inc.

Community Building

Community Funding - Multiple OrgsThird Place Technologies

Science & Tech

Community Funding - Multiple OrgsBrilliance Labs

Community Building

Community Funding - Multiple OrgsCentral Iowa Housing Trust Fund

Community Building

Community Funding - Multiple OrgsFoundation for San Mateo County Libraries

Community Building

Community Funding - Multiple Orgs