Mission

The InnerSource Commons is a thriving community that empowers organisations and people worldwide to apply and gain the benefits of open collaboration in their internal work. Established in 2015, it connects over 3000 individuals from more than 750 companies, academic institutions, and government agencies, fostering a culture of shared knowledge and practical application of InnerSource principles.

Basic Information

Tax-Exempt

Founded in

2020

EIN

84-4206099

Total Assets

$0

At a Glance

Join the Community

Connect with a growing community of InnerSource practitioners ready to share their experiences.

Learn About InnerSource

Access a wealth of resources, including training materials and case studies.

Upcoming Events

Join the next gathering for InnerSource practitioners, now open for registration.

Upcoming Events

InnerSource Summit 2023

2023-11-15

Join us at the world’s largest InnerSource Conference, featuring practitioners from around the globe.

Learn More

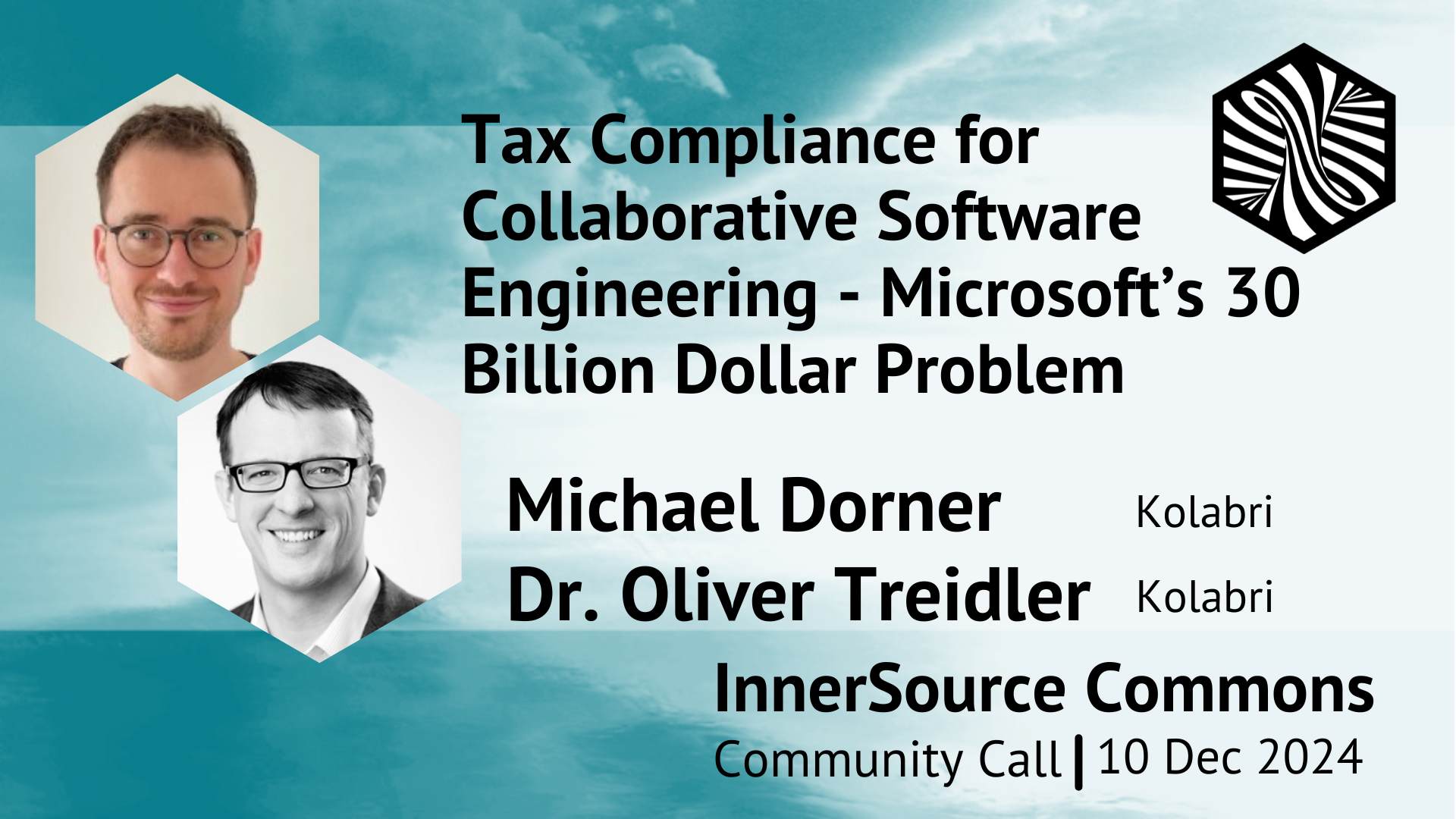

Tax Compliance for Collaborative Software Engineering

2024-12-12

Discuss the challenges and solutions surrounding tax compliance in InnerSource practices.

Learn MoreMIP Score (Beta)

The MIP Score is in beta! We'd love any feedback you may have.

The MIP Score and it's methodology is purely used as a way to visualize how a nonprofits public financial data compares against others. It doesn't reflect the unique circumstances and impact that a nonprofit has.The MIP Score should never be used to say one charity is better than another.

Overall Score

51

50

/100

Program Expense Ratio

88.87%

20

/20

Program Revenue Growth

-46.67%

2

/20

Leverage Ratio

0.02134

20

/20

Working Capital Ratio

0.4113

6

/20

Fundraising Efficiency

0

2

/20

Latest Filing Data: Form 990

Fiscal Year:2022

Source:Source: Self-reported by organization

Financial Details

Revenue

| Category | Amount | Percentage |

|---|---|---|

| Contributions, Gifts, and Grants | 0 | 0.00% |

| Program Services | 140.1K | 99.85% |

| Investment Income | 0 | 0.00% |

| Sales of Non-Inventory Assets | 0 | 0.00% |

| Other Notable Sources | 212 | 0.15% |

| Total Revenue | 140.4K | 100.00% |

Related Nonprofits

Prepare Ai

Science & Tech

Information Science ResearchNational Latina-O Psychological Association

Social Science

Information Science ResearchCode for Science and Society Inc.

Science & Tech

Information Science ResearchMemorial Hermann Community Benefit Corporation

Social Science

Information Science ResearchKanren Inc.

Science & Tech

Information Science Research