Mission

John Jay Youth Lacrosse (JJYL) is committed to developing the sport of lacrosse for youth players of all levels through clinics, camps, and competitive team opportunities. We aim to create a positive environment that encourages both athletic and personal growth.

Basic Information

Tax-Exempt

Founded in

2003

EIN

47-0911845

Total Assets

$99.25 thousand

At a Glance

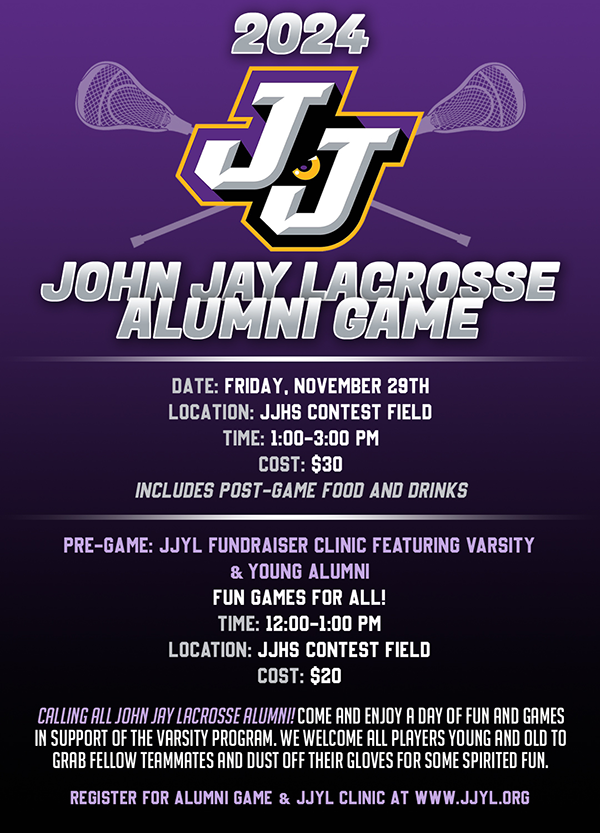

Alumni Game & Clinic

An exciting event bringing together alumni and current players for a day of lacrosse and community.

Winter Boys Clinics

Skill development clinics hosted by varsity coaches and players for grades 1-8.

JJYL Winter Clinics for Girls

Winter clinics for girls, focusing on skill enhancement ahead of the spring season.

Upcoming Events

Winter Boys Clinics

February 6, 2025

Winter clinics for boys hosted by varsity coaches and players.

Learn More

JJYL Winter Clinics for Girls

January 19, 2025

Skill enhancement clinics for girls in grades 1-8.

Learn MoreOur Programs

Winter Boys Clinics

Skill development clinics hosted by varsity coaches and players for youth.

Learn MoreMIP Score (Beta)

The MIP Score is in beta! We'd love any feedback you may have.

The MIP Score and it's methodology is purely used as a way to visualize how a nonprofits public financial data compares against others. It doesn't reflect the unique circumstances and impact that a nonprofit has.The MIP Score should never be used to say one charity is better than another.

Overall Score

53

50

/100

Program Expense Ratio

94.49%

20

/20

Program Revenue Growth

41.88%

18

/20

Leverage Ratio

0

2

/20

Working Capital Ratio

0.6138

8

/20

Fundraising Efficiency

0

2

/20

Latest Filing Data: Form 990

Fiscal Year:2023

Source:Source: Self-reported by organization

Financial Details

Revenue

| Category | Amount | Percentage |

|---|---|---|

| Contributions, Gifts, and Grants | 2.821K | 1.44% |

| Program Services | 168.7K | 86.18% |

| Investment Income | 86 | 0.04% |

| Sales of Non-Inventory Assets | 0 | 0.00% |

| Other Notable Sources | 0 | 0.00% |

| Total Revenue | 195.7K | 100.00% |

Related Nonprofits

Pascack Lacrosse Association

Sports & Recreation

Racquet Sports TrainingTop Performance Tennis Academy

Sports & Recreation

Racquet Sports TrainingMaple Valley Lacrosse Club

Sports & Recreation

Racquet Sports TrainingUrban Squash Twin Cities

Sports & Recreation

Racquet Sports TrainingMetro Squash Nfp

Sports & Recreation

Racquet Sports Training